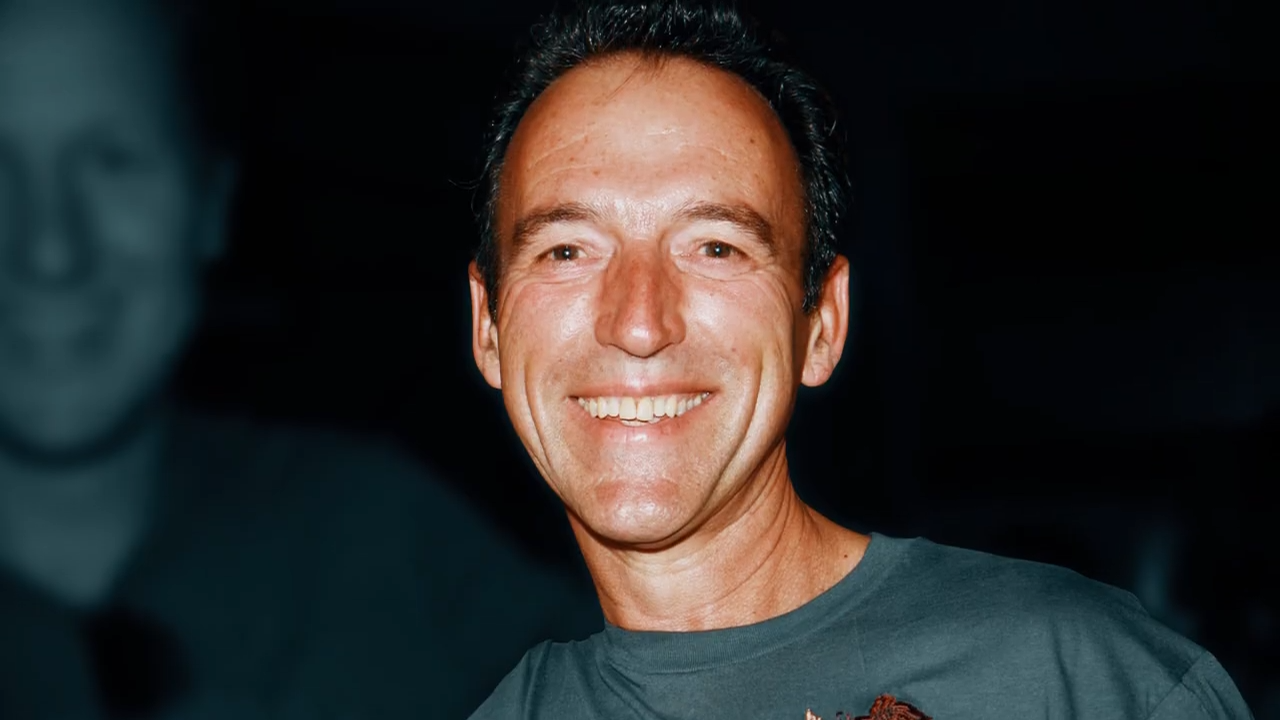

Graeme Hart: New Zealand’s Richest Man

Graeme Hart is a name synonymous with shrewd business acumen, bold investments, and the rise from humble beginnings to becoming New Zealand’s wealthiest and one of the world’s most formidable self-made billionaires. This article delves into the fascinating life, career, Net Worth and legacy of Graeme Hart, examining his early years, breakthrough moments, investment strategies, and personal life.

Introduction

Graeme Hart’s story is a remarkable journey that inspires entrepreneurs and investors around the globe. Known for his mastery in leveraged buyouts and restructuring underperforming companies, Hart has built a vast business empire that spans industries and continents. From modest beginnings to the helm of a multi-billion-dollar empire, his path to success is a testament to perseverance, strategic insight, and a relentless drive to innovate in the world of business.

Early Life and Education

Born in 1955 in Auckland, New Zealand, Graeme Hart’s early life was marked by humble origins. Leaving school at the age of 16, he worked as a tow‐truck driver and panel beater—jobs that, while modest, instilled in him the values of hard work and determination. Despite the challenges of his youth, Hart’s ambition led him to seek further education. He attended Mount Roskill Grammar School and later enrolled at the University of Otago, where he earned an MBA in 1987. This advanced degree not only broadened his business knowledge but also laid the groundwork for his future investment strategies.

Quick Facts At Glance

- Name: Graeme Richard Hart

- Birth Year: 1955

- Nationality: New Zealand

- Net Worth: Approximately US$10 billion

- Major Holdings: Rank Group Ltd, Reynolds Packaging Group, Carter Holt Harvey

- Key Industries: Packaging, Paper, Timber, Investments

- Personal Interests: Yachting, Aviation, Philanthropy

- Education: MBA from the University of Otago

Early Career and Breakthroughs

Hart’s early career is a story of seizing opportunities and transforming challenges into stepping stones for success. One of his first major breakthroughs came in 1990 when he purchased the Government Printing Office at a price below its capital value. This acquisition demonstrated his knack for identifying undervalued assets and turning them into profitable ventures. The following year, he expanded his portfolio by acquiring the Whitcoulls Group—a retail chain that included bookstores and office supplies. These early moves established his reputation as a savvy investor and set him on a trajectory that would eventually redefine the packaging and paper industries.

Building a Business Empire

Central to Graeme Hart’s success is his ability to build a diversified business empire through strategic acquisitions. His private investment company, Rank Group Ltd, has become the cornerstone of his financial empire. Hart’s approach is centered on buying underperforming companies with steady cash flows and transforming them into highly efficient operations. His strategy involves streamlining operations, cutting costs, and reorganizing the companies’ financial structures to maximize profitability.

Over the years, Hart has expanded his holdings by acquiring businesses in the paper and packaging sectors. These investments have not only grown his wealth but have also positioned him as a dominant force in industries that are critical to everyday consumer products. His business model is a classic example of leveraging financial engineering to create value, making him one of the most respected figures in the world of private equity and corporate restructuring.

Investment Strategy and Business Model

At the heart of Hart’s success lies a disciplined investment strategy that focuses on finding hidden value in underperforming companies. Unlike traditional business magnates who often seek rapid expansion through organic growth, Graeme Hart prefers a more calculated approach. His methodology involves identifying companies with strong underlying cash flows but that are undervalued due to operational inefficiencies or market misperceptions.

By acquiring these companies, Hart then implements a series of measures aimed at reducing costs, optimizing cash management, and improving overall operational performance. This approach, often referred to as a leveraged buyout (LBO), allows him to restructure the company’s finances and increase its market value significantly. The ability to transform struggling enterprises into profitable entities has earned him a reputation as a master of financial turnarounds and strategic investments.

Major Acquisitions and Business Ventures

Graeme Hart’s business ventures have had a profound impact on the packaging and paper industries. Some of his most notable acquisitions include:

- Carter Holt Harvey: Acquired in 2006, this deal marked Hart’s entry into the timber and paper sectors. The acquisition not only expanded his portfolio but also provided him with a platform to implement his turnaround strategies on a larger scale.

- Reynolds Packaging Group: In 2008, Hart made headlines by purchasing Alcoa’s Packaging & Consumer group for US$2.7 billion. Following the acquisition, he rebranded the business as Reynolds Packaging Group. This strategic move solidified his presence in the global packaging market and underscored his commitment to creating value through industry consolidation.

- Additional Ventures: Hart’s portfolio also includes other key companies such as Evergreen Packaging, a Swiss packaging company, and several U.S.-based paper packaging businesses. These acquisitions have been instrumental in forming Reynolds Group Holdings Limited—a conglomerate that brings together various packaging businesses under one roof.

Each of these acquisitions highlights Graeme Hart’s unique ability to spot potential where others see risk. By focusing on companies with robust cash flows and untapped efficiencies, he has managed to not only grow his personal fortune but also reshape entire industries.

Personal Life and Lifestyle

Despite his enormous wealth and high-profile business dealings, Graeme Hart is known for maintaining a low profile when it comes to his personal life. He is married to Robyn Hart, and together they have two children. Hart splits his time between multiple residences in New Zealand, including homes in Auckland, Queenstown, and on Waiheke Island. In addition to his New Zealand properties, he owns an island in Fiji and two luxurious homes in Aspen, Colorado.

Hart’s personal life reflects the understated elegance of his business persona. He is an avid yachtsman and enjoys the luxury of high-end superyachts and private jets—symbols of his success that contrast with his modest beginnings. Yet, despite these displays of wealth, Hart remains remarkably private and prefers to let his business achievements speak for themselves.

As of 2025, Graeme Hart’s net worth is estimated at around $10 billion, making him the richest person in New Zealand and one of the wealthiest self-made billionaires globally. His fortune primarily comes from Rank Group Ltd, his private investment company specializing in leveraged buyouts of underperforming businesses, particularly in the packaging, paper, and timber industries. Hart owns a substantial portfolio of companies, including Reynolds Consumer Products, Carter Holt Harvey, and Burns Philp, among others.

His businesses generate billions in revenue, with his U.S.-based ventures alone making over $15 billion annually. Despite his immense wealth, Hart maintains a low public profile, preferring to focus on strategic investments while enjoying a private lifestyle with luxury assets, including multiple yachts, private jets, and high-end real estate in New Zealand, Fiji, and the U.S.

Philanthropy and Political Contributions

Beyond the boardroom, Graeme Hart has made significant contributions to society through philanthropy and political involvement. His charitable endeavors include a generous donation to the University of Otago for a dental teaching facility, showcasing his commitment to education and community development. In the wake of natural disasters, such as the Hunga Tonga–Hunga Ha’apai eruption, Hart has stepped forward with donations of essential supplies and equipment to support recovery efforts.

Politically, Hart has been an active donor, contributing to campaigns and parties that align with his values. His support for centre-right and right-wing political parties in New Zealand underscores his belief in policies that foster business growth and economic stability. These philanthropic and political activities further cement his legacy as not only a successful businessman but also a committed citizen who gives back to his community.

Conclusion

Graeme Hart’s journey from a working-class youth in Auckland to one of the world’s most formidable self-made billionaires is a story of vision, determination, and strategic brilliance. His unique approach to investing—focused on leveraged buyouts and operational restructuring—has allowed him to build a business empire that spans continents and industries. As a pioneer in the packaging and paper sectors, Hart’s influence extends far beyond his personal wealth; he has reshaped entire industries and set new standards for what can be achieved through innovative financial strategies.

In addition to his business success, Hart’s philanthropic efforts and measured political contributions highlight a commitment to giving back and supporting the growth of his home country, New Zealand. His life is a powerful reminder that with the right combination of hard work, strategic insight, and perseverance, even the most challenging beginnings can lead to extraordinary achievements.

This comprehensive biography of Graeme Hart offers a detailed look at the life of a man who not only built a multi-billion-dollar empire but also continues to inspire future generations of entrepreneurs with his relentless pursuit of excellence. Whether through his groundbreaking acquisitions, his innovative investment strategies, or his quiet but impactful philanthropic work, Graeme Hart remains a pivotal figure in the world of business—a true testament to the power of vision and determination.